COMMUNITY

The questions and answers in this section pertain to schools as a part of the community, the economic impact of strong schools, residential growth, and property values.

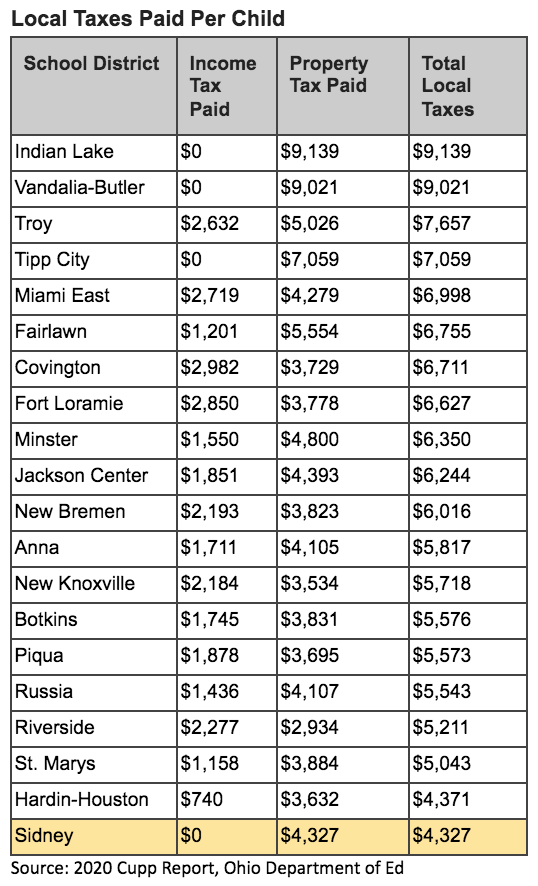

Aren’t our school taxes already high?

Local taxes paid per child comparison shows Sidney at the bottom.

No. Actually, our taxes are among the lowest in our region. Even with the passage of an additional levy, taxes going to the school district would still remain low.

Our combined effective millage places us at the bottom of the chart. Even with the passage of the earned income tax levy, we would still remain near the bottom of the list for total local taxes per child.

Do other schools in the area have income taxes?

Yes, most schools have income taxes. Here are a few throughout the region, and what they are paying:

Anna - 1.5% Income Tax

Botkins - 1.25% Income Tax*

Covington - 2.0% Income Tax

Fairlawn - 0.75% Income Tax

Fort Loramie - 1.5% Income Tax

Hardin Houston - 0.75% Income Tax

Indian Lake - No Income Tax (Property taxes per child are among the highest)

Jackson Center - 1.5% Income Tax*

Miami East - 1.75% Income Tax*

Minster - 1.0% Income Tax

New Bremen - 1.0% Income Tax

New Knoxville - 1.25% Income Tax

Piqua - 1.25% Income Tax

Riverside - 1.5% Income Tax

Russia - 0.75% Income Tax

Sidney - No Income Tax

St Marys - 1.0% Income Tax*

Tipp City - No Income Tax

Troy - 1.5% Income Tax*

Vandalia Butler - No Income Tax (Property taxes per child are among the highest)

*denotes Earned Income Tax

How does Open Enrollment out-Of-District affect finances?

Open Enrollment allows a student to attend school (tuition-free) in a district other than the district where his or her parents reside. There are many pros and cons to this right which was instituted in 1993, although in the end, it is a financial liability for Sidney City Schools. While Sidney does see many students open enroll into the district for various reasons, the number of students open enrolled out-of-district is far greater and saddles the district with a net loss of millions of dollars going to other school districts each year.

The district saw a big jump in open enrollment out following the perilous financial times in the early 2000s, when the district, in order to save money, cut staff and instituted pay-to-play for extracurricular activities. Unfortunately, most of the many families who left during that time never came back.

How does a school system affect the industry and job market in an area?

A strong school system attracts business and commerce, which keeps the local property values high and reduces the tax burden on individual property owners. School performance and school perception are critical to attracting talent to a community, especially families with children. For the Sidney community specifically, our Sidney-Shelby Economic Partnership (SSEP) has identified specific ways the school system affects the industry and job market in our community:

Attracting workforce talent continues to be a critical issue for our local business and industry

Local realtors cite that inability to pass a school levy as a frequent reason that a prospect will move on to the next town

Some local leaders believe that new housing starts, which have been stagnant over the past decade, will not recover until the schools pass a levy and are adequately funded

School systems which aren’t supported by their residents cause business, industry, and families to leave an area.

I don’t have school-age children. What stake do I have in the quality of the schools?

The quality of your schools directly affects the value of your property. Homes sell easier in areas with quality education and solid local support for schools.

A vote for schools protects your investment in your property.

Good schools also attract good people to our community – and to fraternal clubs, churches, and other groups that make a district a good place to grow up, raise a family or retire.

Supporting a school levy in this or any town you live in is essentially an investment in your community.

My kids attend Holy Angels/Lehman or Christian Academy Schools. What are the advantages of me supporting this levy?

Sidney City Schools has a strong and long-standing relationship with the non-public schools within our community. There are a number of accommodations and services Sidney City Schools provides to strengthen the educational opportunities for all students in public and private schools. These include:

Services -- Sidney City supports the identification of students with disabilities who attend the nonpublic schools and supports in securing resources needed to serve students with disabilities.

Strong Partnership -- Sidney City and our nonpublic partners, Christian Academy, Holy Angels, and Lehman, work together to plan and utilize federal grant money that runs through the public school district. This funding stream and planning helps to improve teaching and learning in nonpublic schools as well as strengthen the educational relationship between public and private.

Busing -- Sidney City Schools provides safe, reliable transportation for families whose K-8 students attend Holy Angels/Christian Academy and need this service. There is a cost to maintain buses and replace those that need it.

Ultimately, when the public school system is strong, the economy of the community is strong. These factors drive residential growth. A unique and positive characteristic of the Sidney community IS that families have an opportunity to choose the school system that fits them and stay local. Families moving to the area because of new job opportunities can choose among the strong public and private educational opportunities.

A strong and supported public school only stands to make the private schools stronger.

Why do school districts continue to ask for additional funding?

Levies, or voted mills, are the major source of revenue for most school districts in Ohio, but HB920 (a law enacted in 1976) basically freezes a district’s collection rate on voted millage. so when home values increase, a school district’s voted millage is reduced and the collection rate, also known as the effective rate, remains the same. Except for a one-time increase for new construction, school districts do not see increases in collections on their voted millage due to HB920. For school districts, simply keeping up with inflationary cost increases is challenging under HB920 and also the main reason most districts return to the taxpayers for additional revenue every few years.

What are the major reasons for lack of future growth in revenue?

Lack of growth in state aid

Lagging economic development

Tax-abated commercial and industrial growth in the community - we see minimal tax revenues for ten or more years on many of the commercial/industrial growth projects in the community due to tax abatements. Tax abatements in our district can be 75-100% of the taxable value, ranging from 10-15 years.

How will the Earned Income Tax levy money be used?

The Emergency Levy money will continue to support the operations of the district and help offset the projected deficit we show in our five-year forecast. The money will be used for general operating expenses such as supplies, materials, repairs, staffing needs, and capital improvements. It will help us maintain the excellent programs we currently have. The dollars will help us keep the effort on academic excellence moving forward.

What factors affect the budget?

There are factors that may positively or negatively affect the revenue and expenditures in our district. Depending on how each of these factors changes, the overall financial picture of the district could be significantly impacted. Projections are based on past experience and factual available information.

Factors affecting budget projections.

Residential growth in the district or lack thereof

Tax-abated commercial and industrial growth in the community

Health insurance rates

State and federal budget changes

Economic changes

Student enrollment and open enrollment

Collective bargaining

Unfunded state-mandated programs (CCP, John Peterson Scholarship Autism Scholarship, whole-child education, etc)

Technology needs

Student services and special education needs

Capital improvement needs

How much does the district spend per pupil and how does that compare to neighboring districts?

… Data Coming Soon …

Doesn’t Sidney have a lot of Administration?

When comparing Sidney to smaller schools in our area, it would appear that Sidney has a greater number of administrators, but when you compare Sidney City Schools to schools that are similar in size and scope, like Troy, Piqua, Vandalia, you will see our number of administrators isn’t out of the ordinary. Even when you look at the Pupil Administrator ratio, we operate relatively lean. Additionally, we have cut administrative positions since the data was collected for the 2020 Cupp Report.

Source: 2020 Cupp Report, Ohio Department of Education

What does passing the levy mean to Sidney?

Sidney City Schools does not have any major plans for expansion of its operation. The district has maintained a lean budget while still allowing the school to offer an excellent curricular and extracurricular program for the youth of our community. The funds will keep the excellent academic programs in place and allow us to stay competitive with other schools in the area.

The Board of Education is always reviewing its programs to make sure it is offering the best program possible with the available resources.

What happens if the levy fails?

A levy failure will have a substantial impact on our educational programming. The district continues to assess the necessity of positions where able, especially as staff retire/resign; however, should this levy NOT pass, our district will have to reevaluate the current staff and programs to justify their necessity and make adjustments beyond those cuts we have already made for the 2021-2022 school year. The cuts made to date have had minimal impact on student programs and services but the next round of cuts WILL affect students.

How has student enrollment changed in recent years?

We have seen a decline in student enrollment. This trend is what made us look at reconfiguring our schools and consolidating four K-5 elementary schools into two K-2 primaries, and one 3-4 intermediate school. The overall trend over the last 10 years is that we have seen a decrease in total enrollment per year. Here’s a look at enrollment since 2011.